Are Gift Cards Taxable to Employees?

Are gift cards taxable? If your business purchases gift cards for employees, make sure you’re not missing this important reporting step.

Is That Payment Taxable? 5 Key Tax Facts All Employers Should Know - Procopio

Can a business give away gift cards?

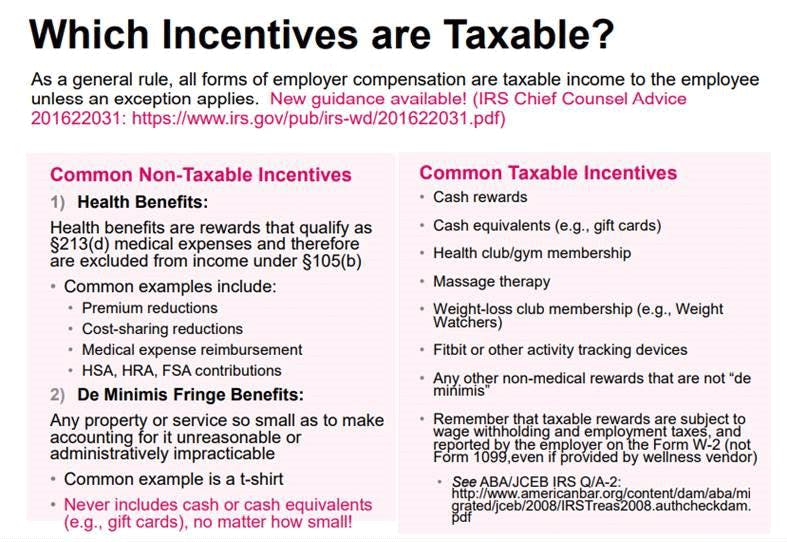

Taxation of Wellness Program Gift Cards

How to give the ideal holiday gift with Tremendous

Received Diwali Bonus via cash, gift card, e-voucher, prepaid

Why would an employer choose to pay a bonus on a gift card? - Quora

Employee Gifts - Tax Implications of Giving Gifts to Staff, Blog

Natalie Miller, CPA, CHFP on LinkedIn: Are Gift Cards Taxable to

Irs 963: Fill out & sign online

Are Gifts to Employees Taxable or Deductible?

Are Gift Cards Taxable Income to Employees?

Complete Guide on Whether Employee Gift Cards Are Taxable Or Not

Finances are Vital to Your Ag Operation

Received Diwali Bonus via cash, gift card, e-voucher, prepaid