Tax Benefits for Child Daycare Providers and Users – Henssler Financial

Special tax benefits are available for those providing daycare services for children and the parents who pay for those services. We take a look at the various tax deductions daycare providers may use and the childcare tax credit that the parents may claim.

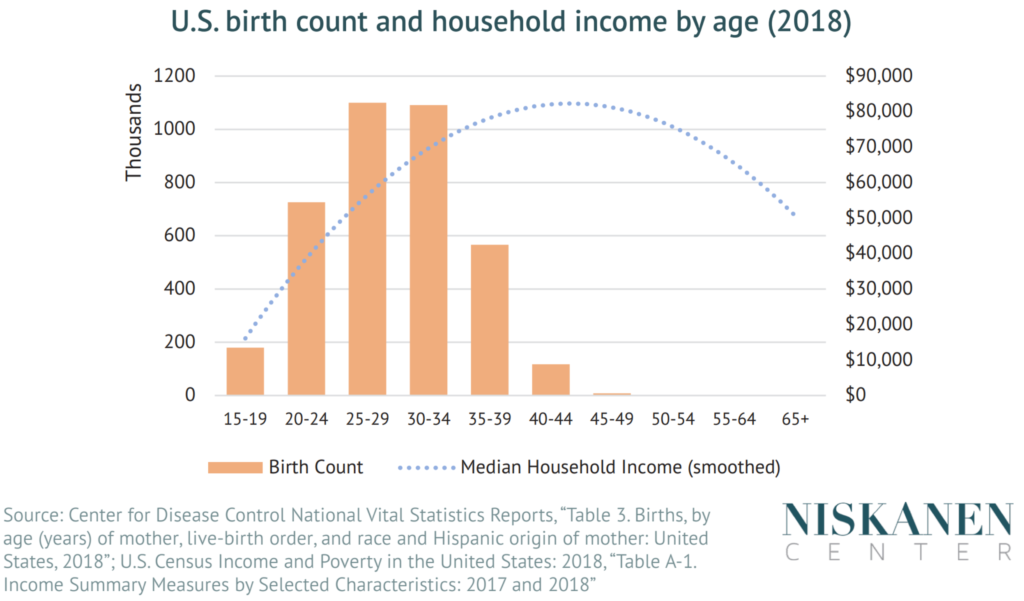

Five Reasons the Child Tax Credit Shouldn't Have a Work

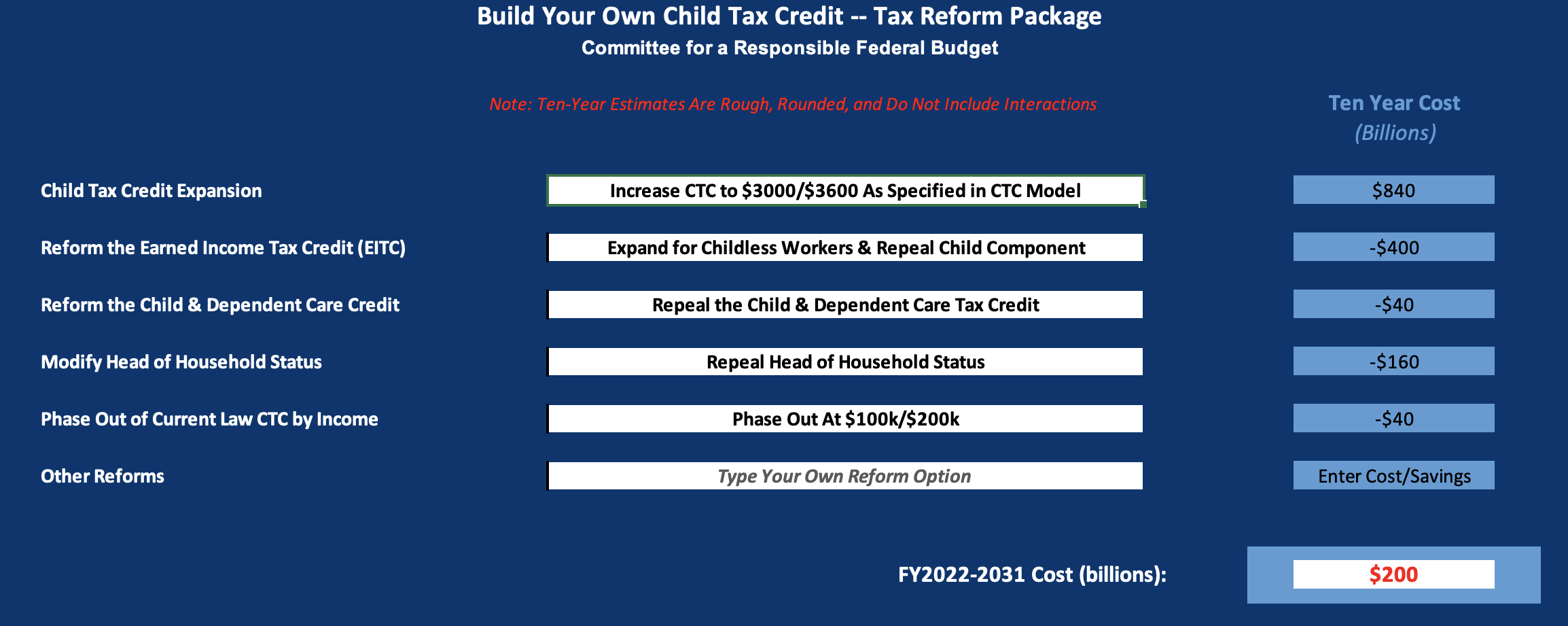

Build Your Own Child Tax Credit 2.0

The Foster Alliance - Arizona Helping Hands

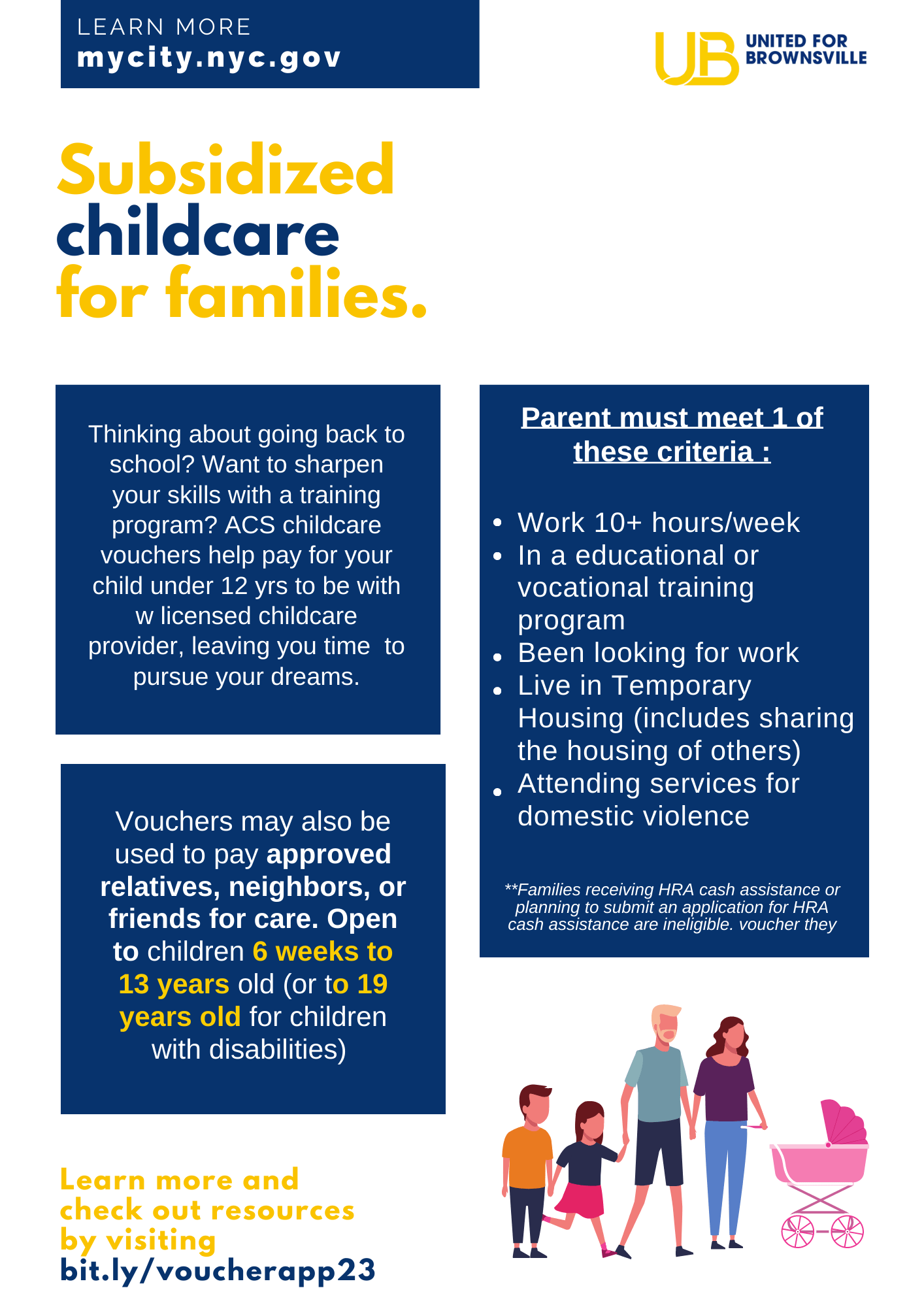

Child Care Financial Assistance Now Available for COVID-19

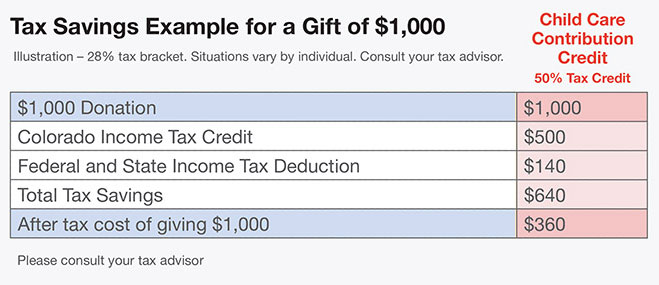

Child Care Tax Credit Ability Connection Colorado

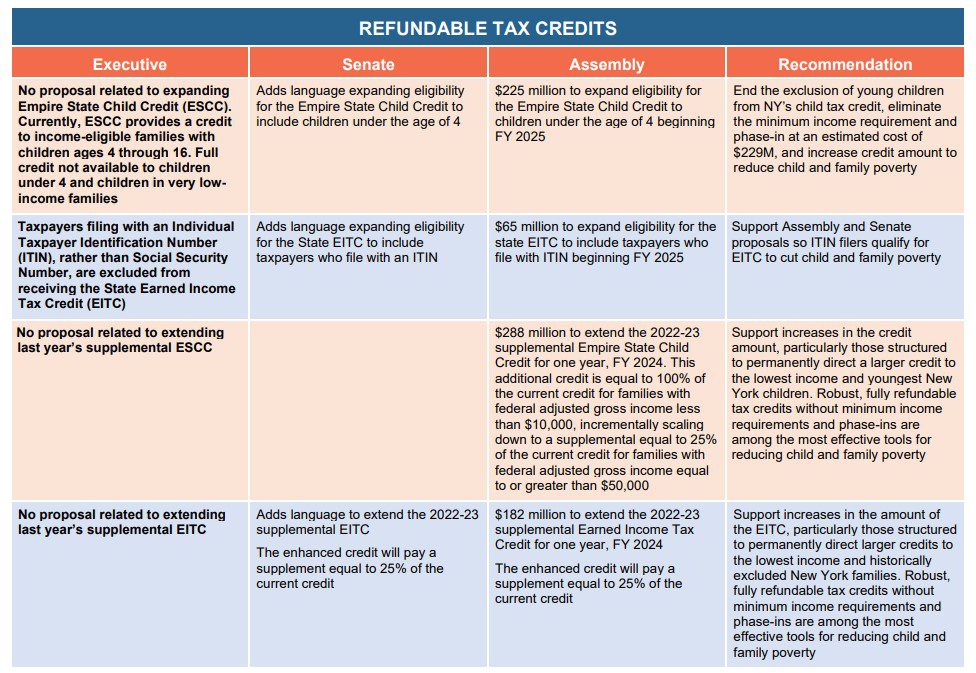

Child Welfare

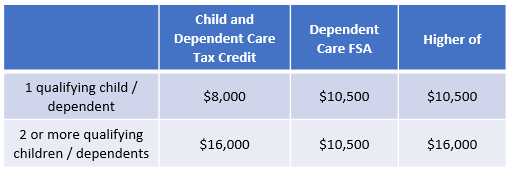

Big Changes to the Child and Dependent Care Tax Credits & FSAs in

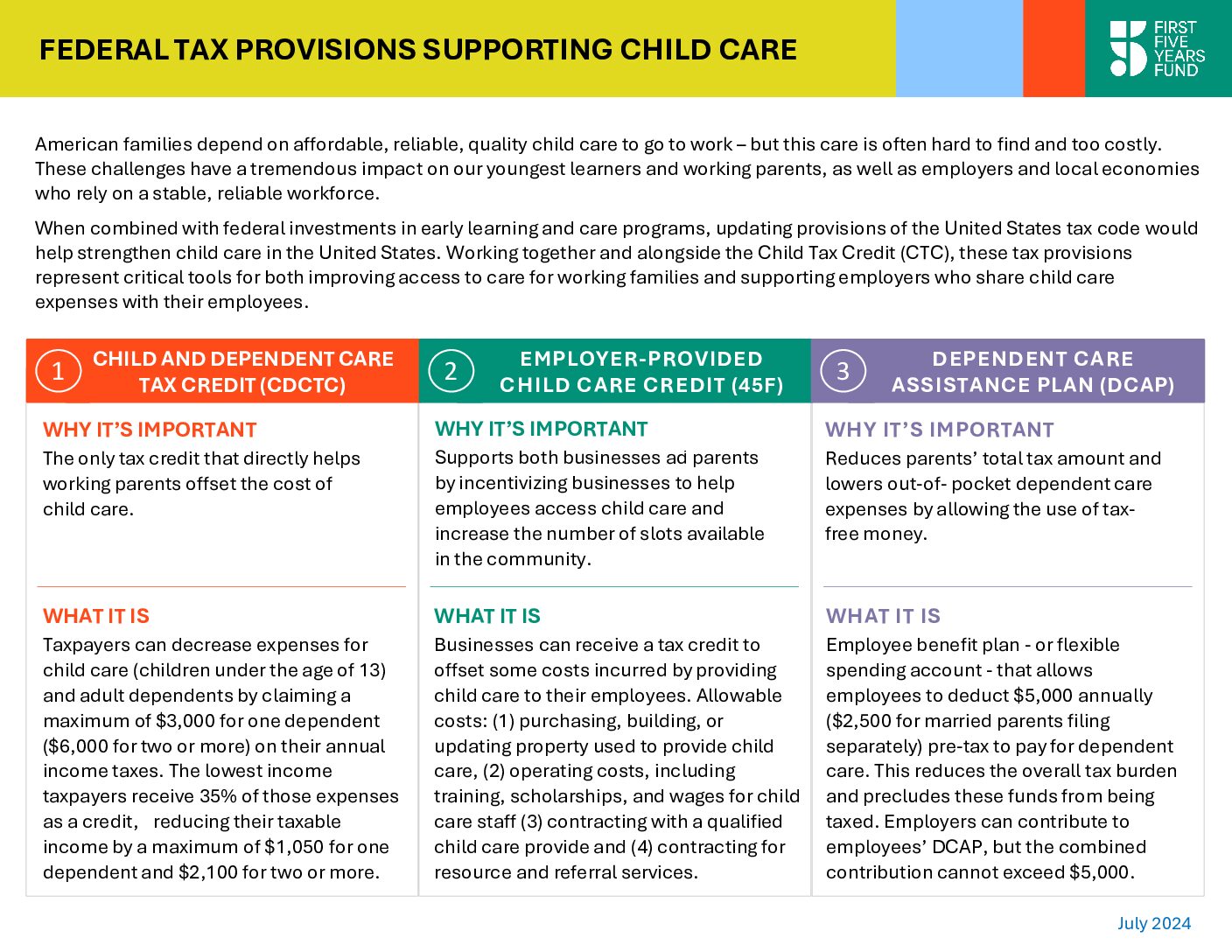

Federal Tax Provisions That Support Child Care

Monthly Payments for Families with Kids – The 2021 Child Tax

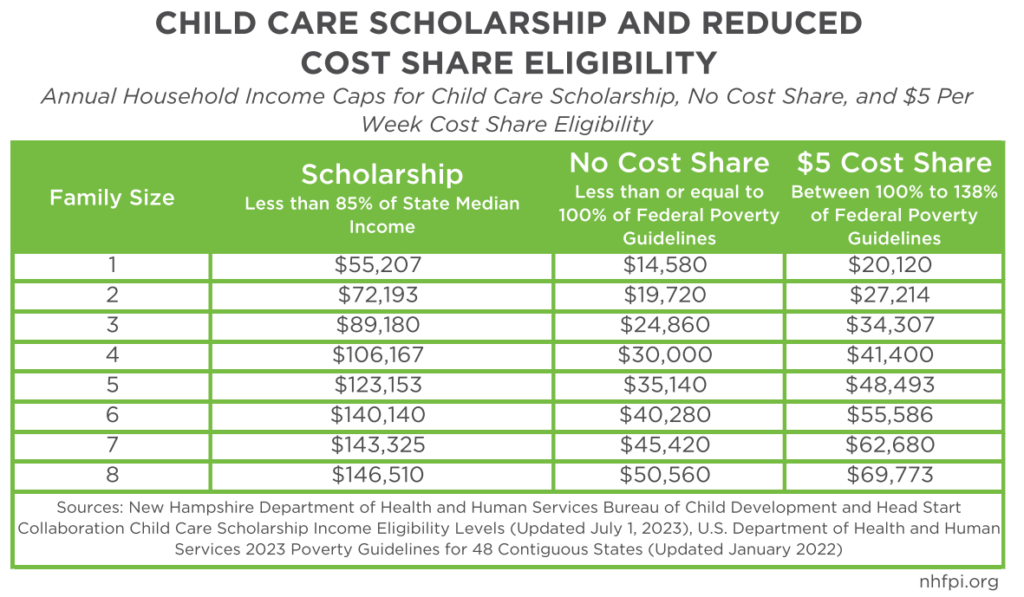

New Hampshire Child Care Scholarship Eligibility to be Expanded in

theSkimm - Here's how a family with two kids could take advantage

Child Tax Credit info for foster parents – FPAWS